Knowledge documents

02 July 2025

2025 European Accommodation Barometer: Industry trends and hotelier sentiment

Knowledge documents

02 July 2025

Adventure tourism

Coastal, maritime and inland water tourism

Cultural tourism

+20 more

Login / create an account to be able to react

-

127

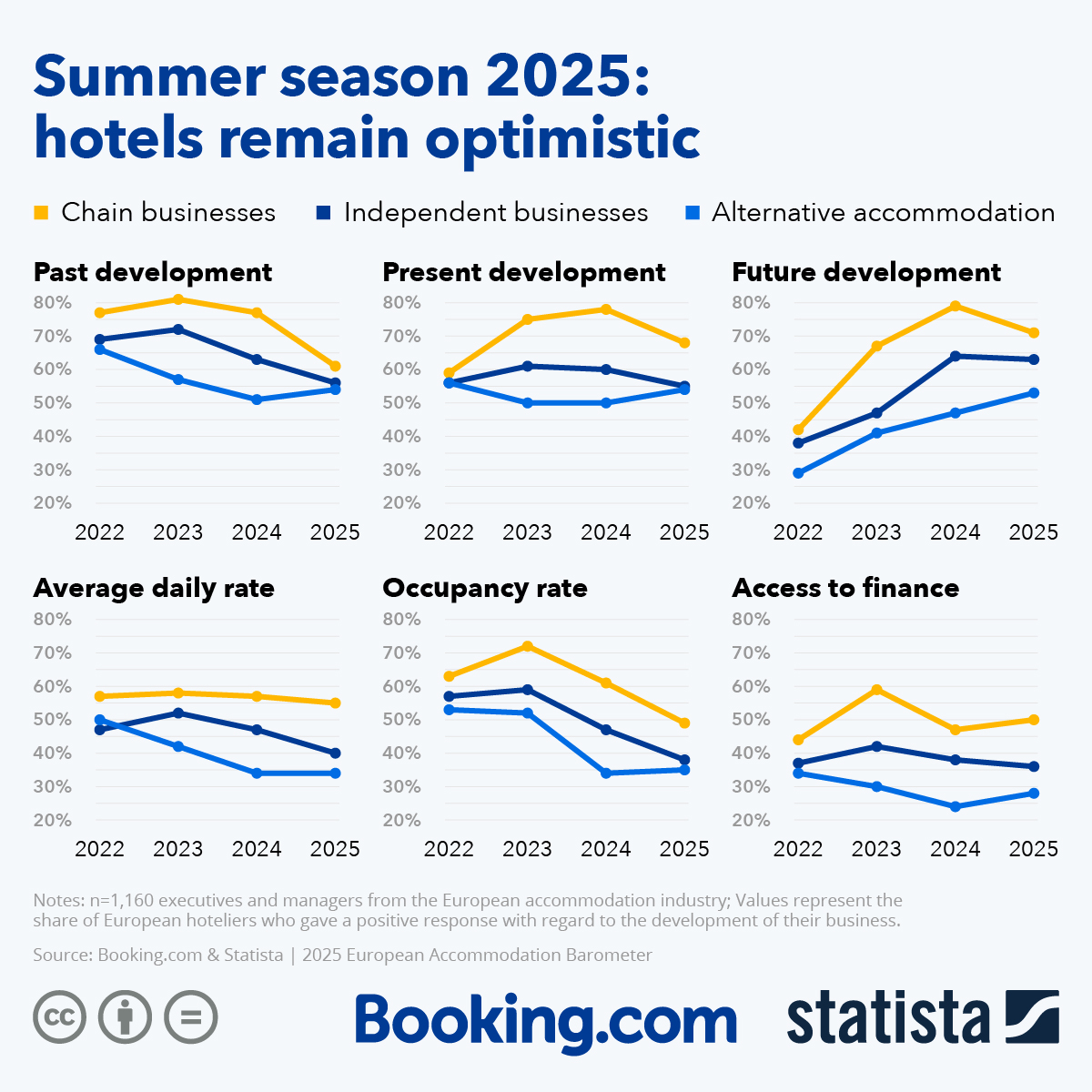

The 2025 European Accommodation Barometer is the fifth edition of the survey conducted by Statista in partnership with Booking.com. It monitors trends in the European travel accommodation sector and captures hoteliers’ sentiment on key industry topics. The report is based on 1,160 interviews with executives and managers from the European travel accommodation sector.

Booking.com

Statista

Topics

Austria

Belgium

Bulgaria

Croatia

Czechia

Denmark

EU-27

Finland

France

Germany

Greece

Hungary

Ireland

Italy

Netherlands

Norway

Poland

Portugal

Romania

Slovakia

Slovenia

Spain

Sweden

Academic / Research and VET Institutions

Company with 250 or more employees

Destination Management & Marketing Organisations

Financial Institutions and Investors

Industry Associations and Chambers of Commerce

International Organisations

Media / Journalist Organisations

SMEs (a company with less than 250 employees)

-

Specific types of tourism

-

-

Adventure tourism

-

Coastal, maritime and inland water tourism

-

Cultural tourism

-

Ecotourism

-

Education tourism

-

Festival tourism

-

Gastronomy tourism

-

Health and medical tourism

-

MICE tourism

-

Mountain tourism

-

Religious tourism

-

Rural tourism

-

Sports tourism

-

Urban/city tourism

-

Wellness tourism

-

-

Transition Pathway Strategic Areas

-

-

Digitalisation of tourism SMEs and destinations

-

Green Transition of Tourism Companies and SMEs

-

Online visibility of tourism offer

-

Short-term rentals

-

-

Business activities

-

-

Camping grounds, recreational vehicle parks and trailer parks

-

Holiday Housing / Apartments and other short stay accommodation

-

Hotel and similar accommodation

-

Other accommodation

-

Share

The 2025 edition of the European Accommodation Barometer, conducted by Booking.com and Statista, reveals a confident and resilient hospitality industry across Europe. Despite ongoing geopolitical and economic uncertainty, sentiment remains strong, with 63% of hoteliers expecting further improvement this season—well above the low point recorded in 2022. Although overall momentum has slowed slightly and regional differences persist (e.g., stronger optimism in Greece and Italy versus greater caution in France and Germany), most accommodation providers continue to report positive trends in occupancy and room rates. Access to capital and investment intentions remain stable, with nearly two-thirds maintaining their investment levels - reflecting sustained confidence in long-term demand.

However, structural challenges persist. Larger, chain-affiliated, and higher-star-rated hotels continue to outperform smaller and independent properties, benefiting from scale in financing, technology adoption, and staff training. Staffing remains a persistent issue, particularly in specialist roles like sales and management, where smaller accommodation providers face the greatest recruitment difficulties. While AI and digital tools offer potential, uptake remains uneven due to cost and integration barriers. Overall, the findings highlight a stable but evolving sector, with resilience at its core and a clear need to bridge gaps in skills and technology.

To access the full report, please visit the attached link.

#Tourism indicators #Eco-friendly accommodations #Reports

Comments (0)

Related content

See also

Sustainable EU Tourism - Key challenges and best practices

- Categories

- Coastal, maritime and inland water tourism Cultural tourism Ecotourism +64 more

Sign-up for the Sustainable EU Tourism Twinning Workshop

- Categories

- Coastal, maritime and inland water tourism Cultural tourism Ecotourism +64 more

Join the Discussion Forum and shape the Future of Tourism ecosystem

- Categories

- Coastal, maritime and inland water tourism Cultural tourism Ecotourism +64 more